FinTech

Kubiko AI

Our proprietary sourcing and underwriting platform that transforms real estate analysis at scale

Combining market data, policy overlays, and custom ESG scoring to identify off-market opportunities and enable institutional deployment with precision and speed.

Kubiko AI

Kubiko AI is our proprietary sourcing and underwriting platform that transforms real estate investment at institutional scale. We combine advanced machine learning with industry-specific data to help investors, portfolio managers, and asset operators identify opportunities, optimize valuations, and monitor performance with unprecedented precision and efficiency.

Intelligent Sourcing

AI-powered deal sourcing across on and off-market opportunities—analyzing thousands of properties in seconds to surface hidden value and mispriced assets.

Automated Underwriting

Data-driven valuation models that incorporate market trends, regulatory patterns, and ESG considerations—delivering consistent, unbiased analysis at scale.

Predictive Analytics

Continuous performance monitoring with predictive maintenance, tenant behavior modeling, and dynamic asset forecasting for proactive portfolio management.

Core Capabilities

-

Market Analysis & Opportunity Identification

Our proprietary algorithms analyze market dynamics, demographic shifts, and policy changes to identify investment opportunities with precision targeting and ESG alignment.

-

Financial Modeling & Scenario Planning

Advanced financial modeling capabilities generate multi-scenario projections, stress testing, and sensitivity analysis to optimize capital allocation and risk management.

-

Ecosystem Integration

Seamless integration with Muebox (asset management) and Ember Rose Homes (tenant experience) creates a unified data ecosystem for continuous performance improvement and predictive maintenance.

Kubiko AI: Transforming Real Estate Analysis at Scale

An advanced AI platform that analyzes, screens, and values thousands of real estate assets in seconds. Through machine learning, market data integration, and custom ESG scoring, we identify investment opportunities and enable institutional deployment with unprecedented precision.

Key Features

- Algorithmic opportunity identification across on and off-market sources

- Multi-factor valuation models with regulatory pattern recognition

- Custom ESG scoring framework with impact-adjusted returns

- Real-time portfolio performance monitoring and predictive analytics

- Seamless integration with Muebox and Ember Rose Homes platforms

How It Works

An end-to-end investment intelligence ecosystem

1. Source

Continuous scanning of market data to identify high-potential properties and portfolio opportunities

2. Analyze

Comprehensive evaluation through multi-factor models integrating location, financial, and ESG criteria

3. Optimize

Scenario-based optimization of investment strategy with dynamic capital allocation modeling

4. Monitor

Continuous performance tracking with predictive analytics for proactive portfolio management

Platform Capabilities

Comprehensive investment intelligence for real estate portfolios

Sourcing Engine

Advanced market scanning system that analyzes thousands of potential investments using proprietary algorithms to surface hidden value and off-market opportunities.

- Multi-source data aggregation

- Anomaly detection algorithms

- Proprietary scoring models

Valuation Suite

Comprehensive financial modeling system that delivers automated underwriting, scenario planning, and sensitivity analysis with institutional-grade precision.

- Multi-variable projection models

- Custom risk analysis

- ESG-integrated valuation

Performance Monitor

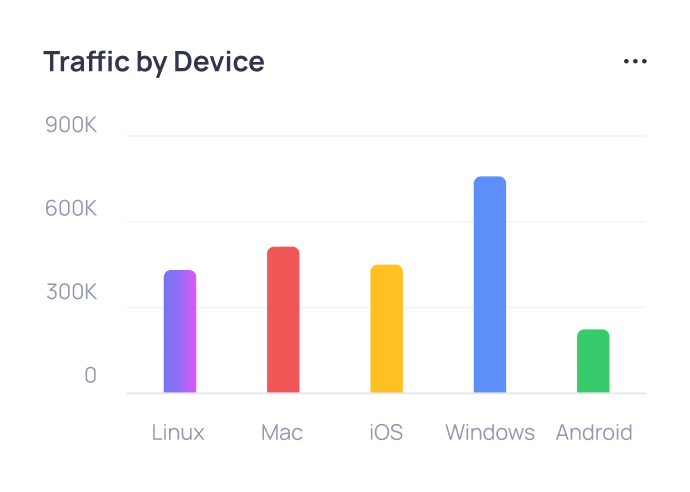

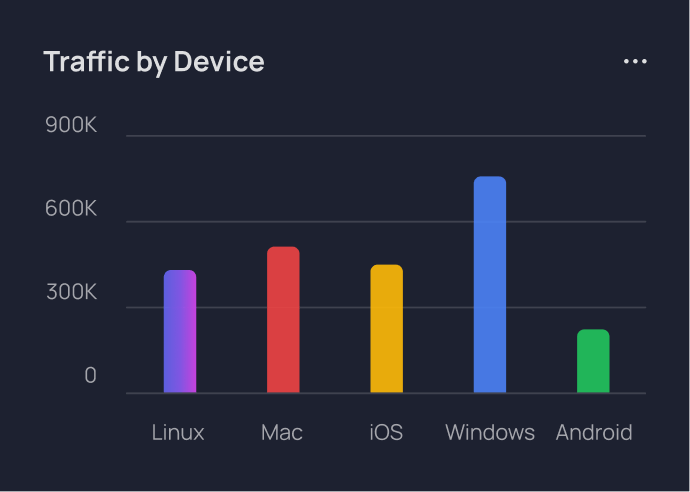

Real-time portfolio tracking system with advanced analytics for predictive maintenance, operational monitoring, and performance optimization.

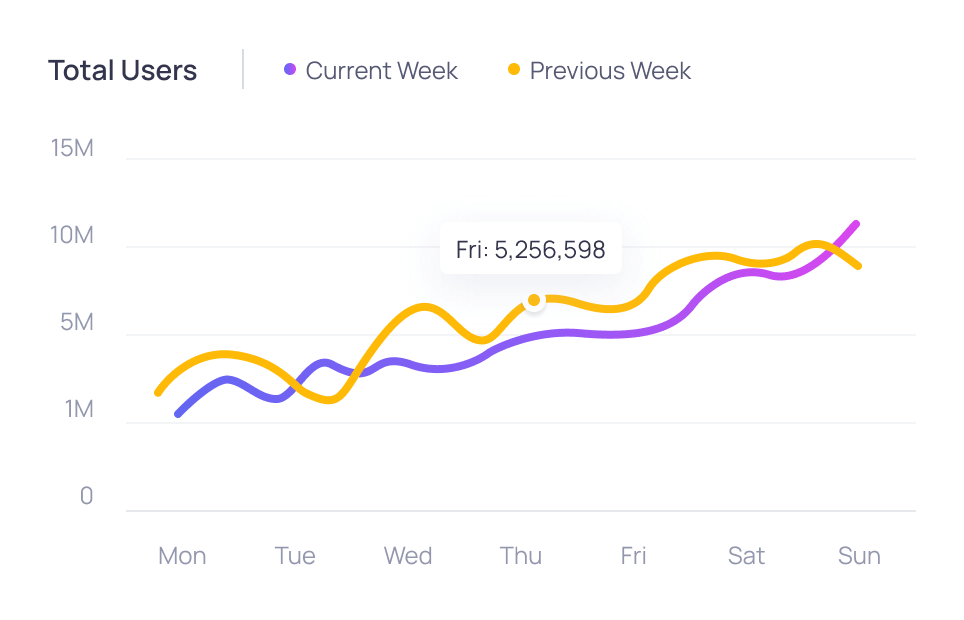

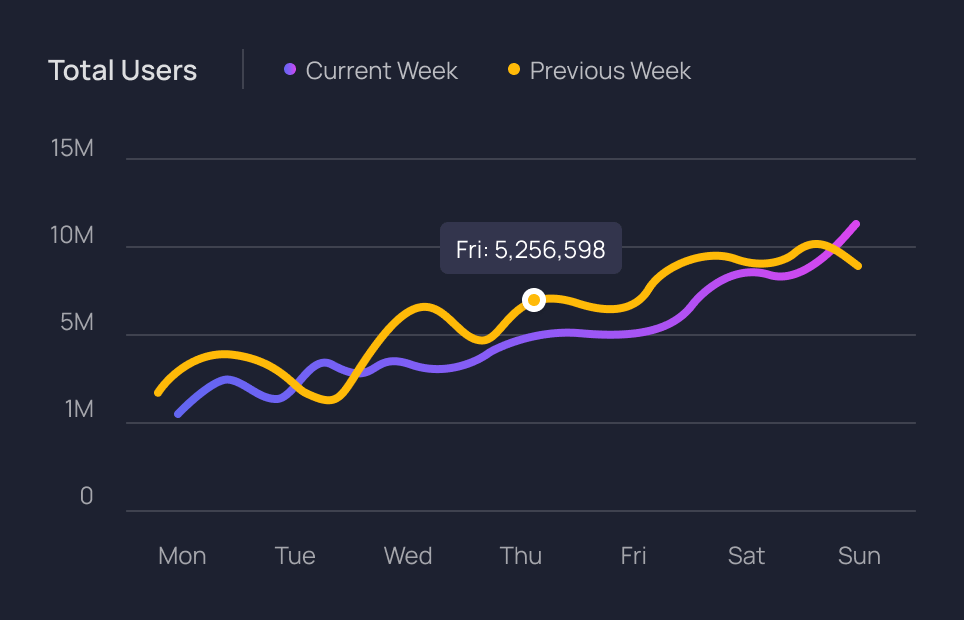

- Dynamic performance dashboards

- Predictive maintenance alerts

- Tenant behavior modeling

Technology Integration

Kubiko AI seamlessly connects with the Kennis Capital technology ecosystem. Portfolio data flows into Muebox for asset management optimization, while tenant insights feed into Ember Rose Homes for enhanced resident experience. The platform provides institutional investors with comprehensive performance analytics through REBL-Cap, ensuring data-driven decision making across the investment lifecycle.

Client Testimonials

Trusted by leading investment firms and asset managers

Transform Your Investment Intelligence

Join leading portfolio managers and real estate investment firms already using Kubiko AI to identify opportunities, optimize valuations, and enhance asset performance.

Join WaitlistEarly access is subject to availability. Real estate valuations and performance predictions are estimates based on available data.

Strategic Outcomes

Transforming real estate investment with AI-powered intelligence and analytics.

AI-Powered Investment Intelligence

Our AI platform delivers actionable investment intelligence that transforms how real estate assets are sourced, analyzed, and managed at institutional scale. By combining machine learning with proprietary ESG scoring and multi-factor valuation models, we enable faster, more accurate decisions throughout the investment lifecycle.

Key outcome metrics:

| Opportunity Discovery | 85% faster identification of high-potential properties with algorithmic screening across on and off-market sources. | |

| Valuation Precision | 37% improvement in valuation accuracy with multi-factor models that incorporate market trends and policy changes. | |

| Performance Enhancement | 23% reduction in operational costs through predictive maintenance and tenant behavior modeling. | |

| ESG Integration | Comprehensive ESG scoring with SFDR, GRESB, and TCFD alignment for impact-adjusted portfolio analytics. |

Partnering with Kubiko AI

Empowering organizations with cutting-edge AI solutions tailored to your industry needs.

Ready to transform?

Email usLet's discuss your needs

Schedule a demoWe provide comprehensive AI solutions including predictive analytics, natural language processing, computer vision, and machine learning models. All solutions are developed with scalability in mind, ensuring long-term value and alignment with your organization's strategic objectives.

We function as a technology partner and integration specialist. Our solutions are designed for seamless integration, with flexible APIs and adaptable frameworks. Whether through direct integration, cloud deployment, or hybrid models, we tailor each implementation to your technical infrastructure and operational requirements.

Absolutely. Our AI solutions are developed to meet industry-specific regulatory standards including GDPR, HIPAA, and financial sector compliance requirements. We work with your legal and compliance teams to ensure all AI implementations adhere to your governance framework and regulatory obligations.

Definitely. We specialize in developing bespoke AI solutions tailored to unique business challenges. From data collection and preparation to model development and deployment, we handle the entire AI lifecycle. Our team works with your subject matter experts to create solutions that deliver measurable ROI.

We implement comprehensive monitoring systems including model performance metrics, business KPI dashboards, and ROI tracking. Clients receive access to real-time analytics platforms ensuring transparency and continuous performance optimization throughout the AI lifecycle.

Our implementation timeline ranges from 2-3 months for standard solutions to 6-9 months for complex enterprise integrations, depending on scope and complexity. We use agile methodologies to deliver value incrementally, with early proof-of-concept deployment to validate approaches and accelerate time-to-value.