CarbonTech

Klarbon

Klarbon is Kennis Capital's carbon intelligence platform that transforms decarbonisation efforts into measurable financial yield.

Our comprehensive carbon platform quantifies, verifies, and monetises carbon savings from retrofitted housing stock. Through real-time measurement, reporting, and verification (MRV), registry integration, and carbon credit sales, we enable property owners and investors to capture value from sustainability investments.

Klarbon Carbon Intelligence Platform

Klarbon is Kennis Capital's comprehensive carbon intelligence platform that quantifies, verifies, and monetizes carbon savings from retrofitted housing stock. Through real-time measurement, reporting, and verification (MRV), registry integration, and carbon credit sales, we transform decarbonization efforts into measurable financial returns. Our platform seamlessly integrates with the broader Kennis Capital technology ecosystem, providing housing associations, property owners, and investors with transparent environmental data and carbon monetization pathways.

Carbon Accounting

Advanced measurement and verification technology that quantifies carbon reductions across property portfolios, providing detailed emissions baselines, reduction measurements, and compliance documentation.

Registry Integration

Direct connections to leading carbon registries and verification bodies, ensuring that all credits meet international standards for additionality, permanence, and regulatory compliance.

Credit Monetization

End-to-end carbon credit issuance, bundling, and sales platform that transforms verified emissions reductions into tradable carbon credits and financial returns for portfolio owners.

Platform Capabilities

-

Real-Time MRV Dashboard

Continuous emissions monitoring and verification system that integrates with IoT sensors, smart meters, and energy management systems to provide accurate, real-time carbon performance data across property portfolios.

-

ESG Reporting Engine

Automated reporting tools that generate TCFD, PCAF, GRESB, and SFDR-compliant documentation, integrated with Muebox for registered providers and REBL platforms for investor transparency.

-

Carbon Marketplace

Secure trading platform for verified carbon credits with direct connections to voluntary and compliance markets, corporate offtakers, and ESG-focused investors—maximizing financial returns from decarbonization efforts.

Transforming Carbon Reductions into Measurable Value

Klarbon quantifies, verifies, and monetizes carbon savings from retrofitted housing stock through advanced MRV technology, registry integration, and market access—converting sustainability improvements into verified carbon credits and financial returns for property owners and investors.

Klarbon: Quantifying and Monetizing Carbon Reductions

A comprehensive platform that measures, verifies, and monetizes carbon savings from retrofitted housing stock. Through advanced MRV technology, registry integration, and market connections, we transform decarbonization efforts into verified credits and financial returns.

Key Features

- Real-time emissions monitoring with IoT integration

- ISO 14064-3 compliant verification methodology

- Direct integration with leading carbon registries

- Automated ESG reporting for Muebox and REBL users

- Portfolio-wide carbon credit bundling and monetization

How It Works

A complete carbon intelligence ecosystem

1. Measure

Continuous monitoring of energy use and carbon emissions across retrofitted properties

2. Verify

Independent validation of carbon reductions through third-party registry standards

3. Monetize

Conversion of verified carbon reductions into tradable credits and financial returns

4. Report

Comprehensive ESG reporting and analytics for portfolio owners and investors

Platform Capabilities

Comprehensive carbon intelligence for property portfolios

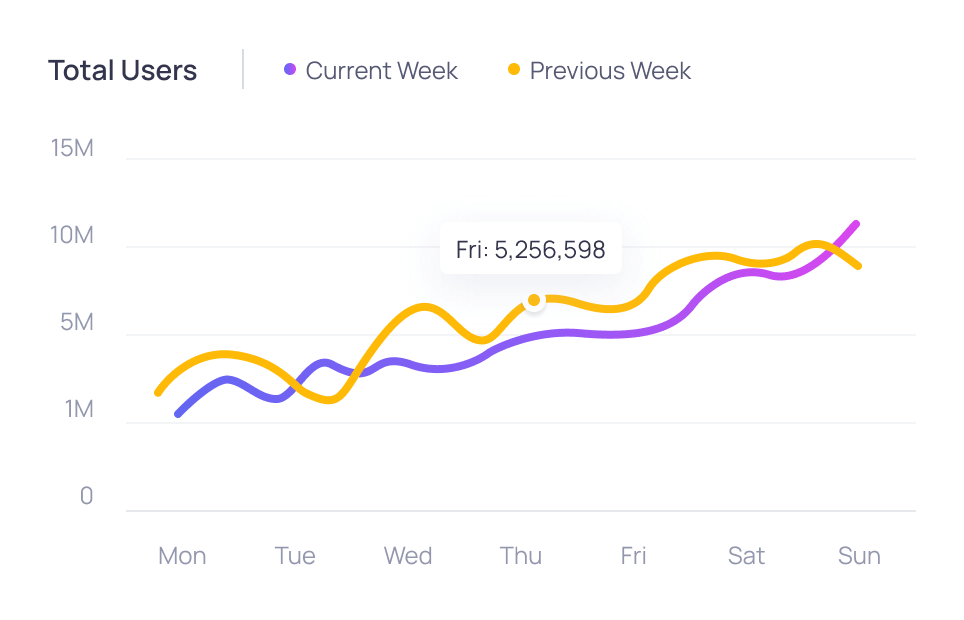

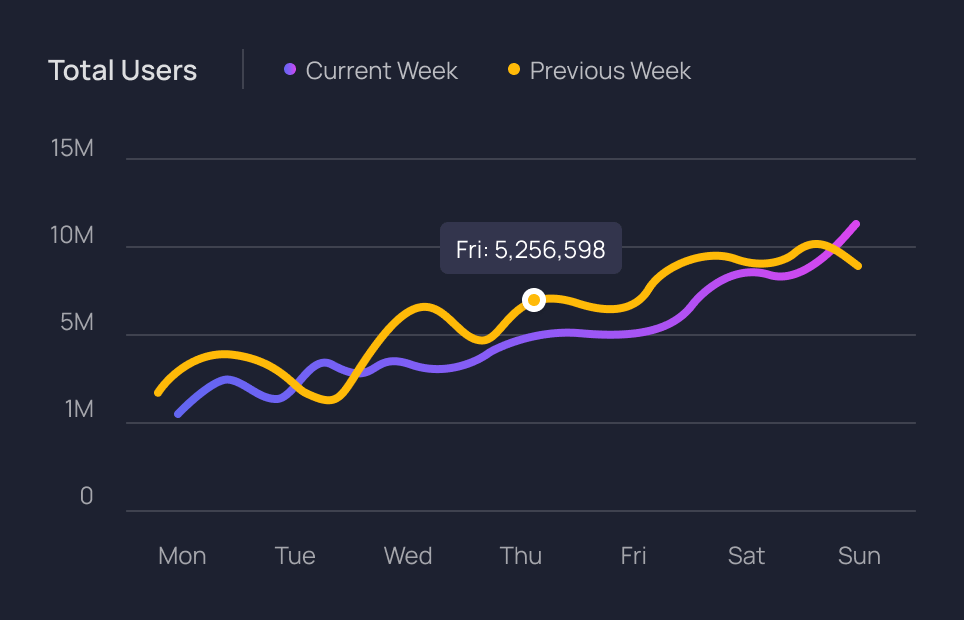

MRV Dashboard

Real-time measurement, reporting, and verification system that integrates with IoT sensors and smart meters to provide accurate carbon performance data.

- 24/7 emissions monitoring

- Baseline comparison analytics

- Portfolio-wide visualization

Verification Engine

Advanced carbon accounting and verification system that ensures all credits meet international standards for additionality, permanence, and regulatory compliance.

- ISO 14064-3 compliance

- Registry integration

- Audit-ready documentation

Carbon Marketplace

End-to-end platform for carbon credit issuance, bundling, and sales, connecting property portfolio carbon savings to voluntary and compliance markets.

- Market access integration

- Corporate offtaker network

- Automated settlement

Technology Integration

Klarbon seamlessly connects with the Kennis Capital technology ecosystem. Housing associations and registered providers access carbon data via their Muebox account, while investors receive portfolio efficiency reports through REBL-Cap (institutional) or A-REBL (retail) platforms, ensuring transparency and compliance across the investment lifecycle.

Client Testimonials

Trusted by leading housing providers and investors

Transform Carbon Reductions into Value

Join leading housing providers and property owners already using Klarbon to measure, verify, and monetize carbon savings across their portfolios.

Request DemoCarbon credit values fluctuate based on market conditions. Historical performance is not indicative of future returns.

Carbon Intelligence Platform

Quantifying, verifying, and monetizing carbon savings from retrofitted housing stock across the Kennis Capital ecosystem.

Carbon Intelligence & Monetization

Klarbon is Kennis Capital's carbon intelligence platform that quantifies, verifies, and monetizes the carbon savings from our retrofitted housing stock. Through real-time MRV, registry integration, and carbon credit sales, Klarbon transforms decarbonization into yield across our housing and energy ecosystem.

Key platform features:

| Carbon Verification | Real-time monitoring, reporting, and verification (MRV) of carbon reductions with third-party validation to gold standard methodologies. | |

| Registry Integration | Direct integration with carbon registry platforms for seamless credit issuance, tracking, and retirement across voluntary carbon markets. | |

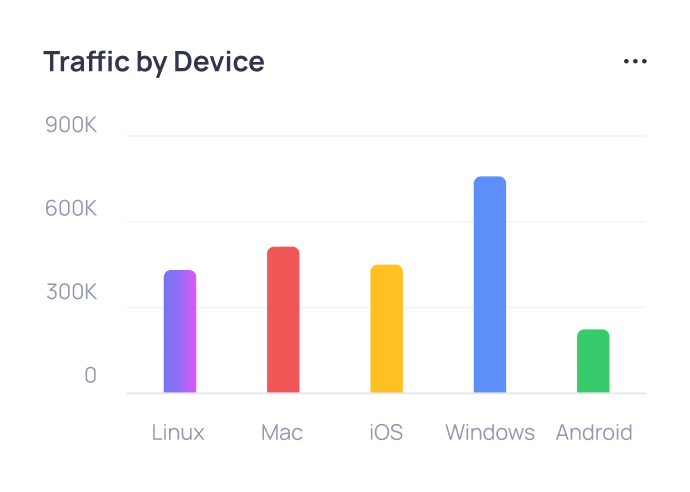

| Portfolio Analytics | Comprehensive property-level energy efficiency analytics accessible to RPs via Muebox and to investors through REBL-Cap and A-REBL platforms. | |

| Revenue Aggregation | Bundling and monetization of carbon credits at portfolio scale to maximize financial returns and enable cross-subsidization of retrofit economics. |

Frequently Asked Questions

Essential information about Klarbon's carbon intelligence and monetization platform.

Have specific questions?

Contact our teamRequest a demo

Schedule sessionKlarbon employs a comprehensive Monitoring, Reporting, and Verification (MRV) system that tracks real-time energy usage and carbon emissions across retrofitted property portfolios. Our platform collects data through smart meters, IoT sensors, and proprietary monitoring equipment installed during retrofit. This data is processed through our carbon accounting algorithms and verified against established methodologies recognized by major carbon registries. We employ third-party validation to ensure all carbon credit claims meet international standards for integrity and accuracy.

Klarbon integrates with major carbon registries including Gold Standard, Verra (VCS), UK Woodland Carbon Code, and Puro.earth. We've developed specific methodologies for built environment energy efficiency and retrofit carbon accounting that align with these registry requirements. Our platform handles the entire carbon credit lifecycle from project registration and monitoring through to issuance, trading, and retirement. We continuously work with registry partners to develop new methodologies specific to housing retrofit and built environment decarbonization.

Klarbon is fully integrated with the Kennis Capital technology ecosystem. Registered Providers access Klarbon's property efficiency analytics via their Muebox accounts, allowing monitoring of carbon performance alongside property management. Institutional investors receive portfolio efficiency reports through REBL-Cap, while retail investors access simplified metrics via A-REBL. Klarbon also connects with Sanufa's Virtual Power Plant to combine carbon and energy monetization, creating a comprehensive ESG yield platform across the entire property portfolio.

Klarbon generates several types of carbon credits across our housing portfolios, including energy efficiency credits (from building envelope improvements), renewable energy credits (from solar installations), embodied carbon offsets (from materials and construction), and additionality credits for enabling early deep retrofit. Each credit type follows specific registry methodologies with appropriate baselines, monitoring protocols, and verification procedures. We bundle credits at portfolio scale for optimal monetization, with premium pricing achieved through our high-integrity approach and social co-benefits from affordable housing.

Klarbon implements a multi-layered approach to data integrity. Our system employs redundant monitoring, calibration protocols, and data validation algorithms to ensure accuracy at point of collection. We utilize blockchain-based immutable records for carbon accounting and implement regular third-party verification of both methodologies and data outputs. All reporting follows TCFD and PCAF frameworks, with quarterly verification by independent auditors. This robust approach ensures high confidence in our carbon measurements and monetization, critical for both regulatory compliance and voluntary market participation.

Klarbon monetizes carbon credits through multiple channels, including direct sales to corporate buyers, trading on voluntary carbon exchanges, and structured offtake agreements with institutional partners. We optimize pricing through portfolio bundling, quality premiums, and social co-benefit attributes. All revenue generated across our portfolios is aggregated and distributed to bondholders in line with pre-agreed coupon (interest) rates. This centralized approach ensures predictable returns for investors while creating a sustainable funding model for ongoing decarbonization initiatives and enabling cross-subsidization of deeper retrofits across the property portfolio.

Klarbon supports comprehensive ESG reporting aligned with major frameworks including TCFD, SFDR, GRI, and GRESB. Our platform automatically generates tailored reports for different stakeholder requirements, from detailed PCAF-aligned carbon accounting for institutional investors to simplified impact metrics for retail participants. We provide full transparency on carbon methodologies, additionality proofs, and performance tracking. For regulatory requirements, we support SFDR Article 8/9 reporting and UK Streamlined Energy and Carbon Reporting (SECR), ensuring all partners can meet their disclosure obligations efficiently.

For Registered Providers and housing partners, Klarbon delivers multiple benefits: detailed energy efficiency analytics accessible through Muebox, enabling targeted maintenance and improvement planning; monetized carbon credits that improve retrofit economics and enable deeper decarbonization; regulatory compliance support for EPC targets and carbon reporting obligations; and enhanced tenant engagement through energy usage insights. Our platform transforms carbon management from a compliance cost to a revenue opportunity, supporting housing providers in meeting both financial and sustainability objectives while improving resident outcomes through reduced energy costs.