Turning Mandate into Momentum.

From strategy to execution, we blend Consulting DNA with Capital Discipline — building resilient platforms, outperforming beta, and delivering durable outcomes.

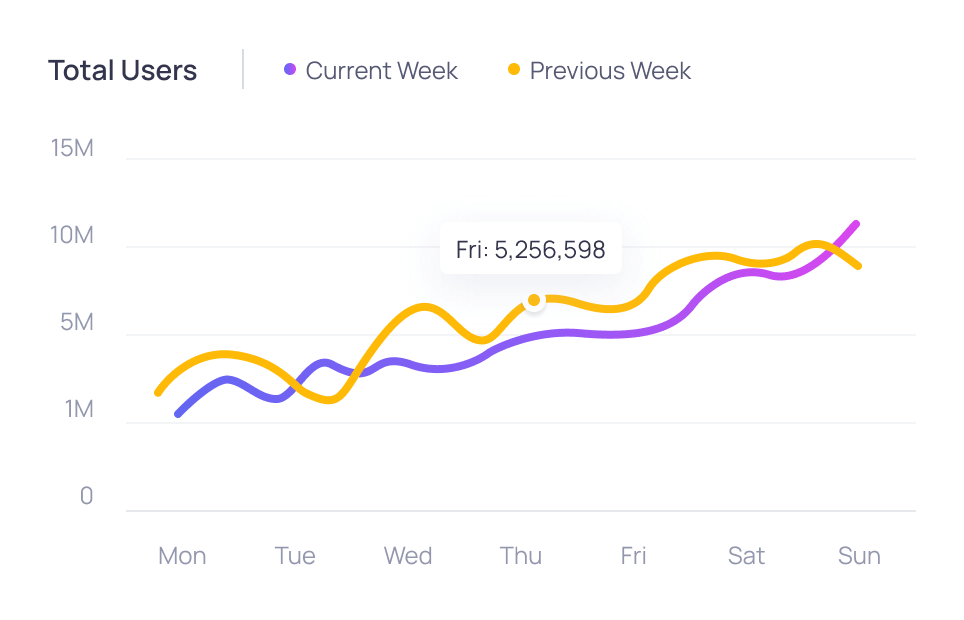

We underwrite ahead of the curve — surfacing dislocations, policy catalysts, and structural shifts before they're priced in. Through macro fluency, data intelligence, and real-world insight, we identify where capital can lead — not lag — innovation and impact.

Whether we're backing infrastructure, digitizing operations, or transforming real estate — our execution playbook compounds performance through clarity, control, and capital discipline.

Operational Alpha. Delivered.

From strategy to execution, we blend Consulting DNA with Capital Discipline — building resilient platforms, outperforming beta, and delivering durable outcomes.

What Guides Our Execution

- How we secure revenue visibility before deploying capital

- Why operational alpha beats financial engineering

- How capital is recycled with discipline, not haste

- Where ESG, data, and design converge to future-proof platforms

- What it takes to build portfolios that compound

The Execution Model

Anchor Revenue Early

Secure forward income streams or off-take agreements to lock in demand before capital is deployed.

Acquire with Intention

Target undervalued assets, platforms, or infrastructure that align with long-term macro and thematic tailwinds.

Create Value Through Intervention

Execute targeted improvements — operational, technical, or design-led — that enhance performance and resilience.

Integrate ESG + Technology

Retrofit sustainability and embed data systems to unlock efficiencies, transparency, and long-term compliance.

Revalue Based on Enhanced Performance

Translate improvements into yield uplift, valuation gains, or strategic optionality.

Recycle Capital to Compound Growth

Monetize, refinance, or reinvest proceeds into the next opportunity — driving institutional-grade returns at scale.

Whether we're backing infrastructure, digitizing operations, or transforming real estate — our execution playbook compounds performance through clarity, control, and capital discipline

The Levers of Success

The principles that power our execution.

Identification

Spot what others ignore. Move before others react.

We underwrite ahead of the curve — surfacing dislocations, policy catalysts, and structural shifts before they’re priced in. Through macro fluency, data intelligence, and real-world insight, we identify where capital can lead — not lag — innovation and impact.

Investment

Deploy with discipline. Compound with conviction.

We back durable assets and capabilities — from physical infrastructure to proprietary IP — that deliver persistent value over time. Whether we’re building platforms or acquiring undervalued assets, our investment lens is long-term, thesis-driven, and relentlessly pragmatic.

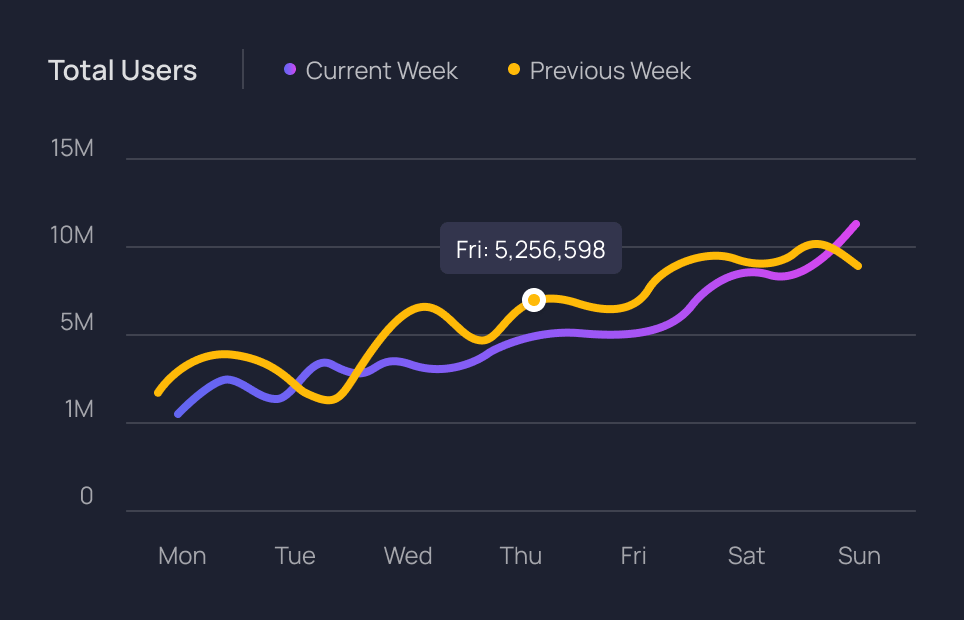

Innovation

Build what the market hasn’t. Operate better than it does.

Our edge is operational — enhanced by systems we design ourselves. From automation in compliance workflows to digital twins in asset management, we engineer solutions that unlock efficiency, resilience, and returns — first for us, then for the market.

Integrity

Act with alignment. Deliver with accountability.

We operate with radical transparency — to our partners, our teams, and our LPs. Every strategy, every structure, and every step is designed to align incentives, surface truth, and preserve trust. That’s how we create value that endures.

Interpolation

Translate capital across borders. Execute with local fluency.

From emerging markets to established economies, we interpolate capital into context — aligning macro mandates with local operating realities. Our teams navigate regulation, policy nuance, and grassroots complexity to deliver results that resonate globally but land locally.

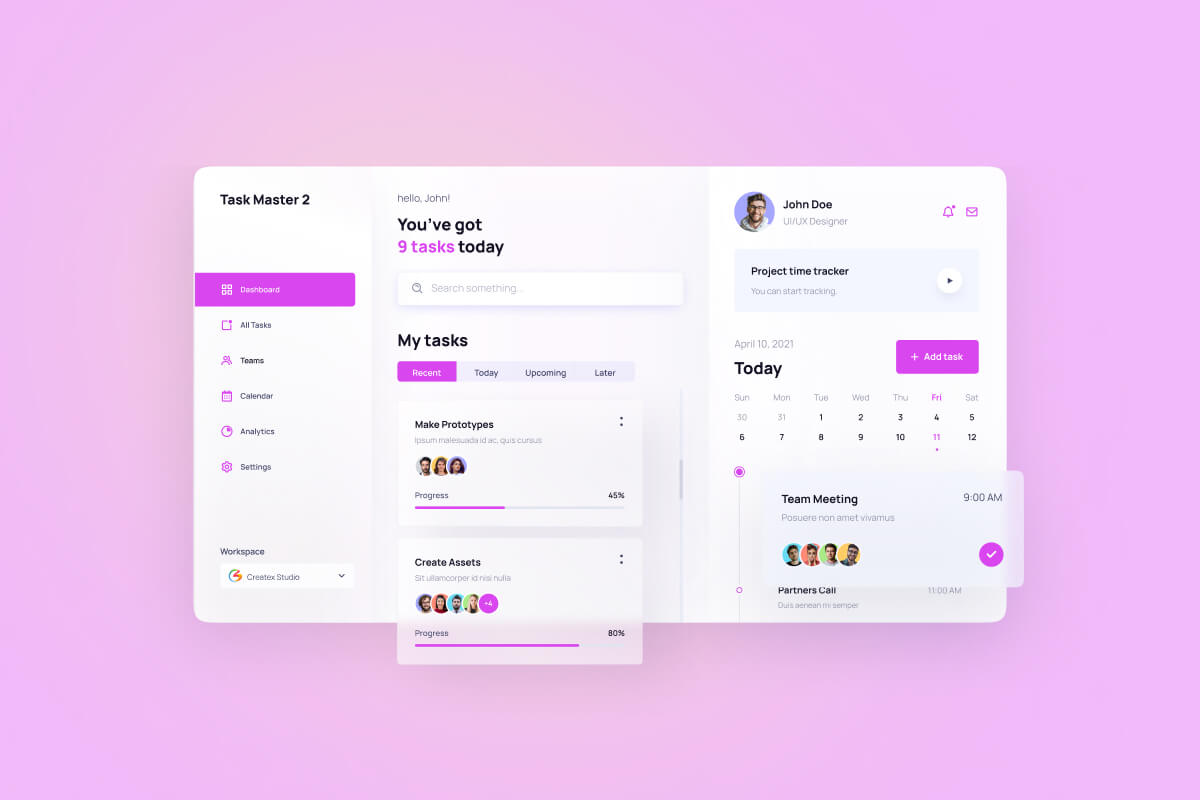

Proprietary Systems, Purpose-Built

If the right system doesn't exist, We build the tools the market hasn't.

Purpose-built platforms. Portfolio-proven performance.

We don’t wait for the market to catch up. When the right platform doesn’t exist, we build it — first to solve internal bottlenecks, then to unlock edge across our entire portfolio. From operational dashboards and ESG analytics to dealflow automation and asset-level monitoring, our proprietary systems create repeatable performance where others rely on spreadsheets.